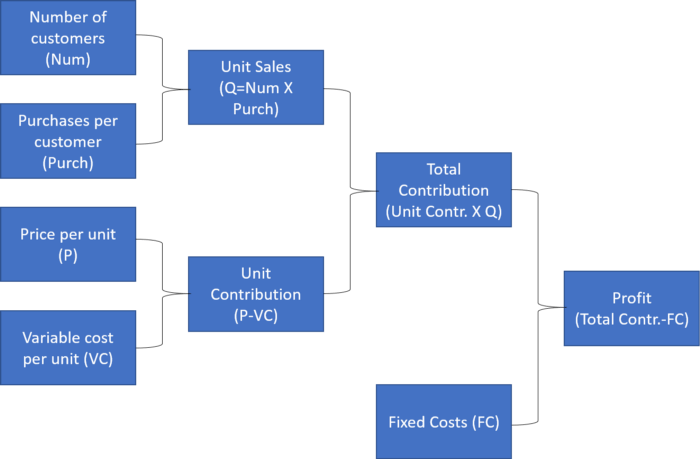

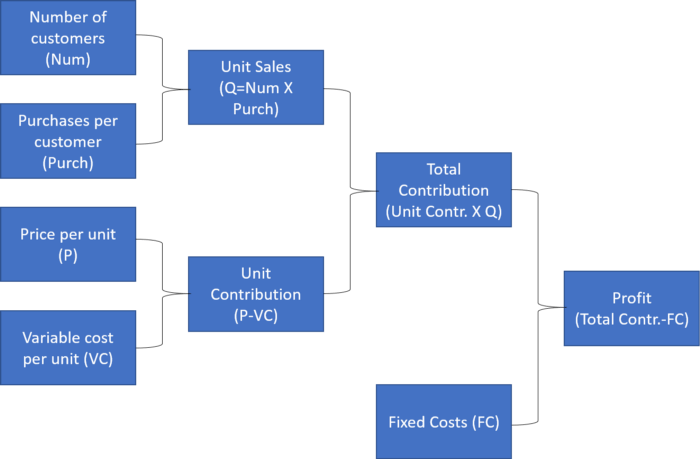

Northeastern University marketing professor Bruce Clark wrote an article titled Financial Analysis for Marketers. He includes a diagram titled How We Get to Profit which pulls together all of the components he defines.

Northeastern University marketing professor Bruce Clark wrote an article titled Financial Analysis for Marketers. He includes a diagram titled How We Get to Profit which pulls together all of the components he defines.

Peter Eavis and Lauren Hirsch wrote an article for the New York Times titled After Failed I.P.O., WeWork Will Go Public Through a Merger.

Continue reading “SPAC Acquires WeWork”Marketing-Finance Alignment. December 10, 2020. Zoom discussion with Shahin Khan, Doug Garnett, Michael Douglas, Alastair Thomson. Alastair is the author of Cash Flow Surge. Continue reading “Marketing-Finance Alignment”

Marc Rubinstein wrote an article titled The Business of Benchmarking, which includes the history of the meter, the shipping container, Nielsen TV ratings, FICO scores, stock indices (DJIA, S&P500, FTSE, Russell, MSCI, etc.), and bond ratings. Continue reading “The Business of Benchmarking”

I am reading the B2B Institute’s B2B Trends, which is excellent so far. But on p.14, while I agree with their point about long-term brand building, I question a supporting statement:

« Good CFOs understand that businesses are valued not on current cash flows but on future cash flows. By some estimates, 80% of the value of your stock is based on sales 10+ years in the future. »

So I posted the question of Twitter and got some insightful responses.

Continue reading “Is 80% of stock value based on earnings >10 years into the future?”

A Twitter thread about the need for marketing and finance to work together led to an interesting comment from business school professor Bruce Clark about profitability. Continue reading “growth vs. profit”

By Samuel Brealey wrote an article titled Marketers, it’s time to grow up and talk to Finance. Continue reading “Marketers have to talk to Finance”

Dr. Augustine Fou wrote a blog post titled Humans Don’t Hyperscale. Sorry, Silicon Valley. Continue reading “Humans Don’t Hyperscale”

CFA Society Atlantic Canada hosted a webinar titled Complexity, Turing, Covid and the Financial Analyst presented by Rick Nason, associate professor of finance at Dalhousie University. See the end of this post for links to Prof. Nason’s books. Continue reading “Complexity, Turing, Covid and the Financial Analyst”

An interesting Twitter thread on financial ratios. Continue reading “Enterprise Value: Is EV/EBITDA a better ratio than P/E?”